The 2025 Budget Is Here—And It’s a Middle-Class Revolution

Let’s cut to the chase—the 2025 Budget has dropped, and if you’re part of India’s middle class, this one’s for you. Forget dry policy jargon. Imagine this: Zero taxes on income up to ₹12.75 lakhs. Yes, you read that right. But how? What’s the catch? And what does this mean for your wallet? We’re diving deep into the details, reactions, and hidden gems of this historic budget.

What Sparked the Buzz About Budget 2025?

Key Highlights from the YouTube Budget Breakdown

A now-viral YouTube video broke it first—with a detailed, almost cinematic deep dive into Budget 2025. With colorful charts, slow claps for tax cuts, and a rollercoaster of reactions, the video quickly became the go-to explainer for aam junta.

Why Middle-Class Families Are Celebrating

Zero tax up to ₹12.75 lakhs? That’s not just a headline—it’s historic. For decades, tax relief danced just out of reach. Now, there’s actual relief on paper—and people are calling it a “middle-class Diwali.”

What Does “Zero Tax up to ₹12.75 Lakhs” Really Mean?

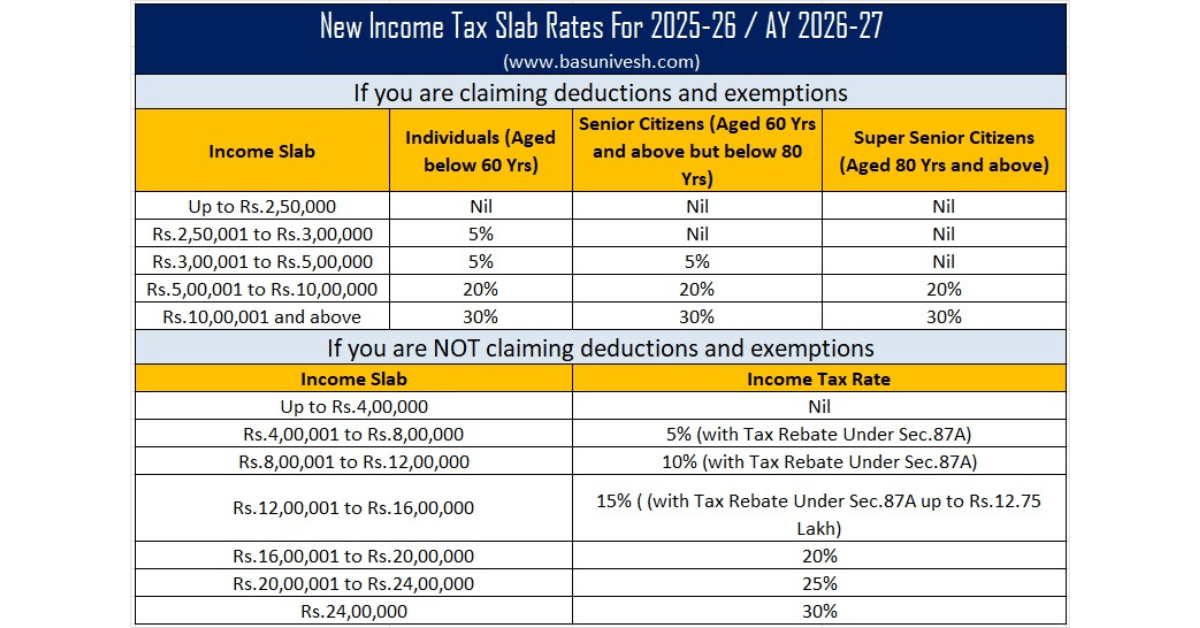

Breaking Down the Tax Slab Changes

Here’s the juice:

No tax for income up to ₹12.75 lakhs (under new regime).

Standard deduction revised to ₹75,000.

Tax rebate (Section 87A) extended.

How It Impacts Different Income Groups

Middle-income earners (₹7L–₹13L) benefit most. Lower earners (<₹5L) were already exempt. But high earners? You’re still in the bracket—just slightly less squeezed.

The Bigger Picture – What Else Was Announced?

Housing Loan Benefits for the Middle Class

Deduction on interest hiked to ₹3.5 lakhs for first-time home buyers. Finally, some incentive to dream of your own 2BHK (without sobbing over EMIs).

Education and Healthcare Allocations

₹1.8 lakh crore for education

₹1.5 lakh crore for healthcare

Biggest takeaway? Increased funding for scholarships and free diagnostics in public hospitals.

Fuel Prices and Daily Life Costs

Excise duty tweak means fuel prices may dip. A bit. Maybe don’t get too excited—savings = chai, not champagne.

Middle-Class Reactions – From WhatsApp to Wallets

Social Media Celebrations and Criticism

Twitter is split:

“FINALLY! Some respect for taxpayers!” – @BrokeButHopeful

“Too little, too late. Inflation still eating us alive.” – @MiddleClassMohan

Real People, Real Stories – Budget Hits & Misses

Priya, a teacher in Pune: “It’s the first time I smiled reading a budget.”

Ramesh, a freelance designer: “Still struggling—tax cut doesn’t help with rent doubling.”

Who Gains and Who Misses Out?

The Silent Struggles of Lower Middle Class

Lower middle-income groups feel ignored. No direct subsidies, no extra benefits. They fall in the cracks between welfare and wealth.

Higher Income Groups Still Paying Big

Income above ₹15L? You’re still contributing generously to the nation’s piggy bank.

Timeline of Budget Events – From Draft to Declaration

Major Milestones in the 2025 Budget Journey

Nov 2024: Pre-budget consultations begin

Jan 2025: Economic survey tabled

Feb 1, 2025: Budget presented in Parliament

Feb 3: Viral video explains everything better than TV news ever could

Key Statements from the Finance Minister

“This is a budget for the backbone of India—the middle class.”

—FM Nirmala Sitharaman, Budget Speech

Crunching the Numbers – Budget 2025 Statistics You Need to Know

Deficit Targets and Fiscal Goals

Fiscal deficit pegged at 5.2%

Targeted to reduce to 4.5% by 2026

Sector-Wise Allocation

Infrastructure: ₹12.2 lakh crore

Rural Development: ₹1.4 lakh crore

Women & Child Welfare: ₹2.5 lakh crore

Background Check – How Did We Land Here?

Past Budgets vs Present Promises

Compare this to 2018 or 2020—it’s like night and day. Tax slabs were rigid, exemptions messy. Now, we’ve got clarity. And hope.

Middle-Class Expectations Over the Years

Every year, the middle class was like: “This time? Maybe?” Now it’s finally “YESSSS!”

Political Overtones – Is This Budget Election Bait?

What Economists Are Saying

Economists warn it could widen the fiscal deficit—unless offset by higher compliance and better GST collection.

Opposition Parties Respond

“Too little, too late”

“Election stunt”

“Where’s the roadmap?”

You know the drill.

Real Impact or Just Headlines?

Short-Term Gains vs Long-Term Reality

Immediate benefit? Definitely. But whether this translates into sustainable financial growth—that’s still a giant question mark.

Economic Analysts Weigh In

Many call it “budget optics”—a narrative shift without structural reform. But hey, optics can make people vote.

Future Implications – What’s Coming in the Next Fiscal Year?

Can the Government Sustain These Tax Breaks?

Only if they plug leaks—aka tax evasion—and increase compliance.

What Middle-Class Families Should Expect in 2026

More digital reforms, likely tweaks in capital gains tax, and—fingers crossed—more tax-free goodies.

What the Experts Say – Key Quotes and Reactions

From News Anchors to Economists

“It’s a middle-class masterstroke.” – India TV Anchor

“Short-term sugar rush, long-term burden?” – Raghuram Rajan

Quotes That Caught Our Eye

“Budget 2025 is like a hug from a long-lost friend. But you wonder—what’s the catch?”

Your Budget Survival Kit – Tips to Maximise Your Gains

Where to Invest in 2025

PPF & ELSS for tax saving

Index funds for long-term wealth

Gold bonds (still trendy, still tax-efficient)

Smart Saving Ideas Post-Tax Changes

Use the new slab wisely

Invest excess in SIPs

Avoid lifestyle inflation—yes, we see that iPhone in your cart

What’s the Big Deal About the 2025 Budget?

For years, middle-class families have juggled rising costs—education, healthcare, home loans—while tax slabs barely budged. The 2025 Budget flips the script. The headline? Zero tax on income up to ₹12.75 lakhs under the new tax regime. But wait—it’s not just about the numbers. Let’s unpack the why and how.

Key Fact #1: Zero Tax Up to ₹12.75 Lakhs—How It Works

Under the new tax regime:

Annual income ≤ ₹12.75 lakhs: No tax.

Standard deduction increased to ₹1 lakh (from ₹50,000).

Rebates for home loan interest up to ₹3.5 lakhs (vs. ₹2 lakhs earlier).

But there’s a catch: You must opt for the new tax regime and forgo older deductions like HRA or LTA. For families earning ₹10-15 lakhs annually, this could mean savings of ₹1-2 lakhs per year.

Key Fact #2: Healthcare and Education Get a Boost

₹5 lakh health insurance premium deduction for seniors (up from ₹50,000).

Education loan interest deductions doubled to ₹2 lakhs.

New “Green Lifestyle” subsidy: 15% off solar panels or EVs if your income is under ₹15 lakhs.

These aren’t just perks—they’re lifelines for families battling inflation.

Why Now? The Backstory Behind the 2025 Budget

Rewind to 2020: The middle class bore the brunt of pandemic job losses and medical bills. Fast-forward to 2023—73% of middle-income earners said taxes were their top financial stressor (National Survey of Household Finances). The government’s answer? A budget that shifts from austerity to empowerment.

Timeline: From Protests to Policy

2021: Tax protests erupt after fuel prices spike.

2023: Pre-budget surveys show 82% of middle-class voters demand tax relief.

Feb 2025: FM announces “middle-class first” budget, citing “historic inflation relief.”

Reactions: Cheers, Skepticism, and Viral Moments

Public Response: #TaxFreedom trended for 48 hours on Twitter/X. One user wrote: “Finally, a budget that doesn’t treat us like ATMs.”

Experts Weigh In: Economist Raghuram Rajan called it “a bold experiment in demand-side economics,” while critics argue it could widen the fiscal deficit by 0.8%.

Opposition Pushback: “A pre-election gimmick,” says Congress leader Shashi Tharoor.

Future Implications: Will This Budget Change India’s Economy?

Short-term: Consumer spending could spike—think vacations, gadgets, home renovations. Long-term? Risks and rewards:

Pros: More disposable income → higher investments in education/health.

Cons: Reduced tax revenue might delay infrastructure projects.

But here’s the kicker: If the middle class thrives, so does the economy. A 2024 IMF report found that 1% rise in middle-class spending boosts GDP by 0.6%.

FAQs: Your Burning Questions Answered

Is the ₹12.75 lakhs tax-free for everyone?

Only under the new tax regime. Old regime filers still get deductions but higher taxes.Do I need to apply for the Green Lifestyle subsidy?

Yes—submit proof of purchase (e.g., EV invoice) via the IT portal.What if my income is ₹13 lakhs?

You’ll pay 5% tax only on the amount exceeding ₹12.75 lakhs (₹1,250 total).Are education loans for abroad studies included?

Yes, but only for accredited universities.How does this compare to the 2024 budget?

2024 had a ₹10 lakhs tax-free limit. The 2025 version adds healthcare/education sweeteners.What is the new tax exemption limit in Budget 2025?

Zero tax for income up to ₹12.75 lakhs under the new tax regime.Is the old tax regime still available?

Yes, but benefits are now heavily tilted toward the new regime.How does Budget 2025 benefit the salaried middle class?

Through tax breaks, housing loan perks, and deductions.What changes were made in standard deduction?

It was increased from ₹50,000 to ₹75,000.Will fuel prices drop after this budget?

Slightly—due to revised excise duties, but it’s market-dependent.How much is allocated to education?

₹1.8 lakh crore—a significant rise from last year.What’s the fiscal deficit target for FY 2025-26?

5.2%, with an aim to reduce to 4.5% by 2026.What are some investment ideas post-Budget 2025?

PPF, ELSS, NPS, Gold Bonds, and SIPs.- How is the real estate sector affected?

First-time home buyers get higher interest deduction benefits.

Where can I calculate my exact savings?

Use the free calculator at [https://gemscor.com/]—it takes 2 minutes.

The Bottom Line: Is This a New Dawn for the Middle Class?

The 2025 Budget isn’t perfect—no policy is. But it’s a stark shift from “tax and spend” to “save and grow.” For a family earning ₹12 lakhs, the extra ₹1.5 lakhs yearly could mean a child’s college fund, a health emergency cushion, or finally owning a home.

Will it backfire? Maybe. But for now, the middle class is breathing easier—and that’s a win worth celebrating.

CTA: Ready to see how much you’ll save? Click here to use the 2025 Tax Calculator → [https://gemscor.com/]