Why Is Property So EXPENSIVE in India?

It’s Not Just in Your Head

So, you clicked on this article wondering, “Why does a tiny 1BHK cost as much as a spaceship?” You’re not alone, my friend. If you’re feeling like owning a home is a pipe dream wrapped in cement and sealed with debt, well—same. But let’s break it down and find out why prices in India’s property market are higher than your favourite influencer’s ego.

Historical Context – How Did We Even Get Here?

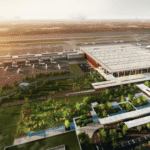

India’s real estate growth over the decades

In the 80s and 90s, property was a long-term investment—not a get-rich-quick scheme. People bought homes to live in, not to flaunt on Instagram. But once liberalization kicked in (thanks, 1991), disposable incomes rose—and so did property values.

What changed post-liberalization?

Foreign direct investment (FDI) poured in. Tech parks mushroomed. Cities sprawled. Suddenly, land wasn’t just land. It was “capital.” People started flipping property like pancakes.

Real estate before and after COVID

Before COVID, things were already expensive. Post-COVID? Developers raised prices citing “material cost inflation” and people bought it—literally. Fear of lockdowns led to a mad scramble for personal space.

The Demand Game – Why Everyone Wants to Own Property

Urban migration and nuclear families

The joint family is out. Nuclear family is in. Every young couple dreams of their own space—hence the demand in cities like Bangalore, Delhi, Mumbai, and Pune.

Aspiration vs affordability

People want luxury. Even if they can’t afford it. Marble tiles, modular kitchens, sea view—even if the budget screams 1RK.

Fear of missing out (FOMO)

“Buy now or regret later.” That’s the sales pitch—and it works. Panic buying is real. Especially when friends are flaunting their new pad on Insta.

The Supply Crunch – Why There’s Always a Shortage

Land acquisition nightmares

Buying land in India is like untangling 500 earphones. Legal battles, ancestral claims, and disputes slow down development.

Government red tape and permits

Want to build a flat? First, get 50 permissions. Then pray. Most projects get delayed because of this bureaucratic maze.

Infrastructure lagging behind

You found affordable land—great! But is there a road? A school? A hospital? No? That’s why it’s “affordable.”

Black Money in Real Estate – Still a Thing?

Demonetization’s impact

Modi’s 2016 demonetization aimed to clean up the mess. It worked—a little. But black money found new ways in.

Reality vs claim: Is under-the-table still happening?

Sadly, yes. A portion of deals still happen off the books. Cash payments are less, but not extinct.

Skyrocketing Construction Costs – What’s Behind It?

Steel, cement, labor, logistics – everything’s pricier

Global inflation, war in Ukraine, and import restrictions raised raw material costs. Add pandemic-induced labor shortage, and—boom—prices doubled.

GST and tax layers

Multiple tax layers make it costlier for builders, who obviously pass it to us—buyers. Thanks, system.

Location, Location, Location – The Urban Price Spike

Tier 1 cities and metro madness

Mumbai, Delhi, Bangalore—these cities are the Bermuda Triangle of property prices. Everything disappears—especially your savings.

Why suburbs aren’t cheaper anymore

Remote work made suburbs trendy. More demand = higher prices. Simple.

Investment Hype – Property as “Safe Gold”

NRIs and property hoarding

Non-resident Indians love parking money in Indian real estate. Safe. Tangible. And it appreciates. Problem? They rarely live in these homes—just own them.

Investor-led inflation

When investors buy in bulk, prices rise for everyone. Genuine buyers suffer. Cue dramatic music.

Government Policies – Helping or Hurting?

RERA, Smart Cities, and their double-edged swords

RERA increased transparency—but also slowed approvals. Smart Cities promised magic but delivered, well… WiFi poles.

Housing schemes that never reach the needy

“Affordable housing for all” is a noble goal. But most schemes are bogged down by corruption and poor execution.

Affordable Housing – Just a Fancy Buzzword?

On-ground reality check

That “affordable” 2BHK? Still costs ₹60 lakh. Add registration, GST, furniture—you’re at ₹75L.

Builders misusing the tag

Affordable housing projects are often in middle-of-nowhere locations with poor build quality. But hey, they qualify for tax benefits!

Millennials and Gen Z – Can They Even Buy Homes?

Why renting is the new owning

With job instability, high EMIs, and better experiences elsewhere, youth prefer renting. No strings attached.

Paychecks vs property prices

Average salary? ₹30,000. Average property? ₹70 lakh. Need we say more?

Foreign Institutional Investors (FIIs) and Real Estate Funds Are Driving Up Prices Quietly

Over the last decade, foreign institutional investors (FIIs) and real estate private equity funds have heavily invested in Indian real estate, especially in commercial and luxury segments. This has led to:

Artificial price inflation: Because developers get upfront funding from these investors, they set higher prices to protect investor interests.

Focus on high-margin projects: Builders prefer premium towers over affordable housing, because investors demand bigger returns. Result? Fewer mid-range and affordable projects.

Global capital > local needs: Cities like Mumbai and Bangalore now attract foreign money like Dubai and Singapore. But this inflates prices beyond the reach of the average Indian.

👉 So while you’re struggling with your EMI calculator, someone in Singapore just bought 50 flats in Gurgaon as a “portfolio hedge.”

India’s Real Estate Is Still 90% Unorganized & Poorly Regulated

Despite reforms like RERA, the ground reality is still murky:

Over 90% of real estate agents in India are unlicensed.

Illegal constructions, land encroachments, and fake documentation are still rampant in Tier 2 and Tier 3 cities.

Many buyers fall into “pre-launch trap” schemes where projects are never completed.

Why does this matter?

Lack of trust = higher prices for verified builders (because they need to insure trust).

Good projects are overpriced to offset the risk of dealing in a broken system.

You pay a “transparency tax”—basically, higher rates for legitimate property.

Real Estate Trends from the YouTube Video

The YouTube video hosted by a real estate expert dropped major truth bombs:

India’s housing demand outpaces supply by 20%

80% of buyers are emotionally driven

Developers manipulate floor area ratio to gain more profit

Real estate contributes 7.3% to India’s GDP

India needs 25 million more affordable homes by 2030

What’s the Future – Will Prices Ever Drop?

Expert opinions

Some say correction is due. Others say India’s urban population boom will keep demand strong.

Predictions for 2025 and beyond

Micro-housing, rental economy, and co-living may see a rise. But don’t expect prices to nosedive.

What Should You Do If You Want to Buy Now?

Tips to avoid being ripped off

Check builder’s RERA ID

Verify all paperwork

Don’t fall for “limited period offers”

Visit the site, don’t trust 3D videos

Alternatives to buying outright

Co-owning with friends/family

Fractional ownership

Renting until better options emerge

👉 Need guidance to plan your property move smartly? Visit https://gemscor.com/ – your guide to smarter decisions.

Conclusion – The Final Word on India’s Property Crisis

Property in India is expensive. Not because of one thing—but because of all the things. Demand, supply crunch, inflated costs, investor greed, failed government policies—it’s a mess. But knowing the facts helps. So the next time someone says, “Real estate is always safe,” you’ll know the truth behind that marble-tiled illusion.

FAQs – Real Questions People Are Asking

1. Why is real estate so expensive in India?

Because of high demand, limited supply, costly construction materials, and policy gaps.

2. Will property prices in India ever come down?

A significant crash is unlikely, but corrections in overpriced areas may happen.

3. Which city in India has the most expensive property?

Mumbai takes the crown—by a long shot.

4. Is buying a house in India worth it in 2025?

Depends on your needs. Financially, renting might still be smarter.

5. How does black money affect property rates?

It inflates prices by encouraging cash-heavy transactions, reducing transparency.

6. What is affordable housing in India?

In theory, housing under ₹45 lakh. In practice, rarely “affordable.”

7. Can NRIs buy property in India?

Yes, and many do—often inflating urban prices.

8. Why are builders charging so much GST?

Because of input costs, tax slabs, and zero input credit on under-construction properties.

9. Is real estate safer than stocks?

It’s tangible but less liquid and can stagnate during market lulls.

10. Should millennials buy property or rent?

Renting offers flexibility, especially in uncertain job markets.

11. How is RERA helping buyers?

It increases transparency but has loopholes many developers exploit.

12. Can you negotiate prices with builders?

Absolutely. Don’t be shy—haggle!

13. What’s the ROI on Indian real estate?

Around 2–3% rental yield—capital gains vary wildly.

14. Is land a better investment than flats?

Land has higher risk and reward. Flats offer steady value with less volatility.

15. Why is property so expensive even in smaller towns?

Migration, aspirations, and digital jobs are pushing prices up everywhere.

Please don’t forget to leave a review.

Explore more by joining me on Gemscor.