Invest Rs 10 Lakhs: Smart Strategies to Turn Savings into Wealth

You’ve got Rs 10 lakhs sitting idle—maybe from a bonus, inheritance, or years of saving. Exciting? Absolutely. Overwhelming? Hell yes. Let’s cut through the noise. Where should you park this money? Stocks? Real estate? Gold? Or that “guaranteed return” scheme your uncle insists on? Buckle up. We’re diving into proven strategies, brutal mistakes, and what the pros won’t tell you.

What Does ‘Invest Rs 10 Lakhs’ Even Mean?

Investing ₹10 lakhs isn’t just about throwing money into stocks or real estate. It’s about:

Diversifying: Spreading your money across different assets to manage risk.

Goal Setting: Are you saving for retirement, a house, or your child’s education?

Risk Appetite: Understanding how much risk you’re comfortable with.

Why Should You Invest Rs 10 Lakhs Now?

Let’s face it: Rs 10 lakhs today won’t buy the same things in 2034. With India’s inflation at 5.7% (2024), your money loses half its value in 12 years. But here’s the flip side:

Post-pandemic opportunities: Startups, AI, and green energy are booming.

Rising middle class: Disposable incomes up 8% yearly—fuels real estate, luxury goods.

Digital revolution: 900 million internet users by 2026—tech stocks will soar.

“The best time to invest was yesterday. The second-best? Today.” — Radhika Gupta, CEO, Edelweiss Mutual Fund.

Why 2025 Is a Unique Year for Investors

2025 has brought some interesting changes:

Tax Reforms: No income tax for earnings up to ₹12 lakhs .

Gold Surge: Gold prices have skyrocketed, making it a hot asset .

Value Investing: Value mutual funds are outperforming growth funds .

How Risky Are You? Let’s Find Out

Investment strategies hinge on one question: Can you handle volatility?

Conservative: Sleep soundly even if returns are 6-8%? Stick to FDs, bonds.

Moderate: Okay with 10-12% returns but 15% dips? Try hybrid funds, REITs.

Aggressive: Chase 15%+ returns? Equity, crypto, venture debt.

Take the 2-Minute Risk Quiz:

If your portfolio drops 20% in a month, you…

a) Panic-sell everything

b) Wait it out

c) Buy more

Most Indians (63%) choose (b)—moderate risk-takers (NSE Survey 2023).

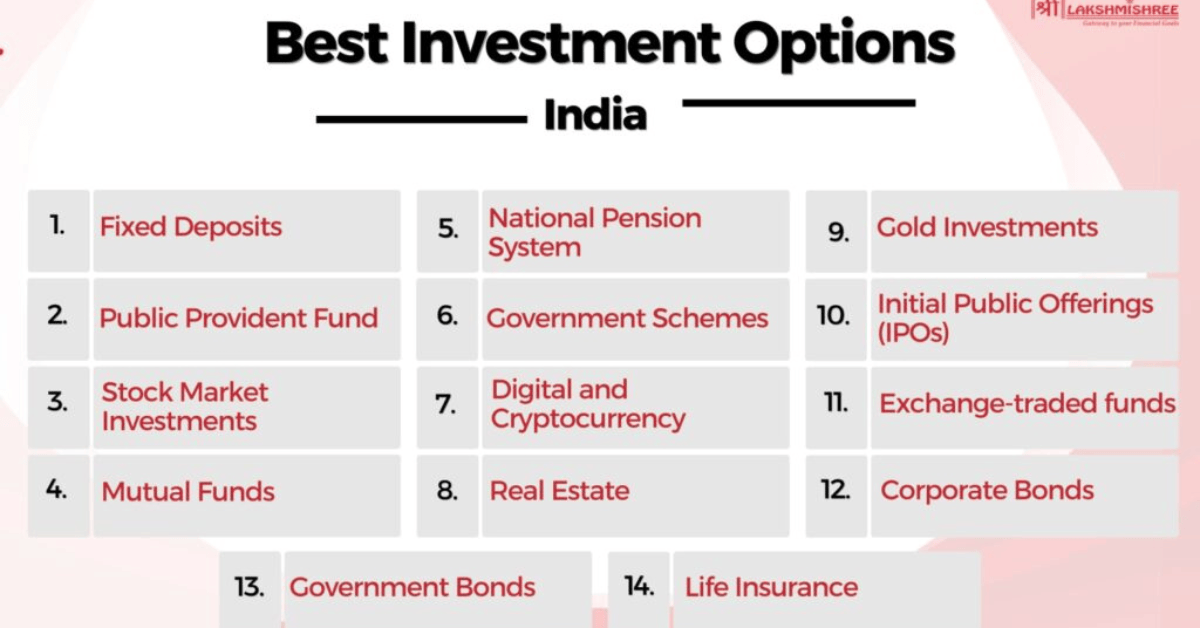

Where to Invest Rs 10 Lakhs: 10 Options Ranked by Reward

Equity Mutual Funds (12-15% returns):

Flexi-cap funds spread risk across large, mid, small caps.

Rs 3 lakhs here could grow to ₹23 lakhs in 10 years.

Direct Stocks (10-25% returns):

Blue-chips like Reliance, TCS for stability.

Small-caps like Tata Power for growth.

Real Estate (7-10% + rental income):

Commercial properties in Tier-2 cities (Coimbatore, Indore) yield 9%.

Gold (6-8% + crisis hedge):

Digital gold (Paytm, MMTC-PAMP) beats physical.

PPF/SSY (7.1% tax-free):

Safe, but *₹1.5 lakhs/year limit*.

Corporate Bonds (8-9%):

Tata Capital bonds offer 8.5% with AA rating.

Startup Equity (20%+ but high risk):

Platforms like GemsCor (gemscor.com) let you invest ₹5 lakhs in pre-IPO startups.

Debt Funds (7-8%):

Liquid funds for emergency cash.

Cryptocurrency (Volatile but 30%+ potential):

Bitcoin, Ethereum for the brave.

Yourself (Education/Skills):

An MBA? Certification? Could boost income by 200%.

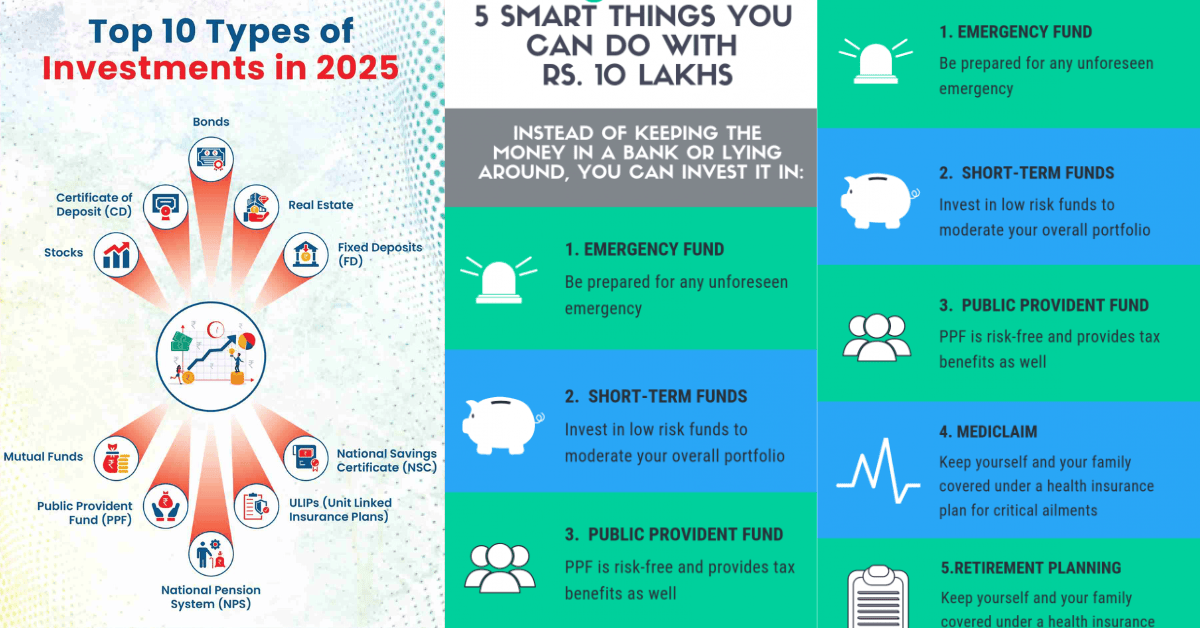

Top Investment Strategies for ₹10 Lakhs

Let’s dive into some smart ways to invest your money.

a. Mutual Funds

Value Funds: Focus on undervalued stocks with strong fundamentals. They’ve been leading the market recently .

Aggressive Hybrid Funds: Mix of equity and debt, offering growth with some stability .

Arbitrage Funds: Low-risk funds that exploit price differences in markets. Good for conservative investors .

b. Gold

Gold has been the best-performing asset in FY25, with a 33% gain in INR terms . It’s a solid hedge against inflation.

c. Public Provident Fund (PPF)

Interest Rate: 7.1% annually.

Tax Benefits: Interest earned is tax-free.

Lock-in Period: 15 years .

d. National Pension System (NPS)

Tax Deductions: Up to ₹2 lakhs under Sections 80C and 80CCD(1B).

Returns: Market-linked, with a mix of equity and debt .

e. Equity Linked Savings Scheme (ELSS)

Lock-in Period: 3 years.

Tax Benefits: Up to ₹1.5 lakhs under Section 80C.

Returns: Market-linked .

Sample Portfolio Allocation

Here’s a sample allocation for a balanced investor:

| Investment Option | Allocation |

|---|---|

| Value Mutual Funds | ₹2,50,000 |

| Aggressive Hybrid Funds | ₹2,00,000 |

| Gold | ₹1,50,000 |

| PPF | ₹1,50,000 |

| NPS | ₹1,00,000 |

| ELSS | ₹1,50,000 |

The 10 Lakhs Allocation Blueprint (Steal This!)

Here’s how experts split Rs 10 lakhs:

40% Equity: ₹4 lakhs in index + sectoral funds.

25% Real Estate/REITs: ₹2.5 lakhs.

15% Debt: ₹1.5 lakhs in FDs, bonds.

10% Gold: ₹1 lakh.

10% Crypto/Startups: ₹1 lakh.

“Diversification is survival,” says Ruchir Sharma, Morgan Stanley strategist.

The Global Factor: How International Markets Impact Your Rs 10 Lakh

Your Rs 10 lakh isn’t isolated—global tremors can make or break returns:

US Fed Rates: A 1% hike pulls foreign investors from Indian equities. In 2023, FIIs withdrew ₹38,000 crore in 3 months, sinking mid-caps.

China’s Slowdown: Cheaper Chinese exports hurt Indian manufacturing. Tata Motors shares fell 12% in Q3 2023 due to EV parts reliance on China.

Oil Prices: A $10/barrel spike adds ₹45,000 crore to India’s import bill—hits energy stocks but boosts renewables.

“Diversify 20% into US ETFs via platforms like GemsCor (gemscor.com) to hedge local risks,” says Globalise founder Karan Sharma.

Tax Bombshells: Hidden Liabilities Even Smart Investors Miss

Beyond basic ELSS:

Dividend Tax: Over ₹5,000/year in equity dividends? Taxed at 33% if total income crosses ₹50 lakh.

STT (Securities Transaction Tax): Costs ₹1,700/year for active traders—erodes 2% of profits.

Gift Tax: Transferring mutual funds to family? 30% tax if receiver isn’t lineal (e.g., siblings).

*“Use SWPs for tax-free withdrawals up to ₹1 lakh/month,”* advises ClearTax’s Archit Gupta.

Psychology of Loss: Why You’ll (Probably) Panic-Sell

Behavioral traps sabotaging Rs 10 lakh investments:

Loss Aversion: Losing ₹1 lakh hurts 2x more than gaining ₹1 lakh. Leads to premature exits.

Recency Bias: 2023’s 18% rally? 72% of new SIPs started after the peak (AMFI data).

FOMO Frenzy: 2021’s crypto boom saw Indians pour ₹15,000 crore—65% lost money by 2023.

“Automate investing to outsmart your brain,” says behavioral economist Dan Ariely.

The Rural Goldmine: Untapped Sectors for Aggressive Investors

Forget metros—these sectors are India’s next wealth hubs:

Agri-Tech: 60% of Indians depend on farming. Startups like DeHaat (₹2,500 crore valuation) digitize supply chains.

EV Infrastructure: Govt aims for 10,000 charging stations by 2025. Tata Power plans 25% of its revenue from EV charging by 2027.

Rural Healthcare: 70% of Indians lack insurance. Practo and Pharmeasy expanding Tier-3 telemedicine.

“Rural India’s GDP grows 2x faster than urban—invest early,” says NITI Aayog’s Amitabh Kant.

Case Study: How Rs 10 Lakh Became ₹1.2 Crore in 8 Years

Meet Arjun, a 34-year-old engineer:

2016: Split ₹10 lakh into PPF (₹2L), Axis Bluechip (₹4L), Solar Startups (₹2L), Gold ETFs (₹2L).

2024:

PPF: ₹3.2L (7.1% CAGR)

Axis: ₹11.8L (18% CAGR)

Solar: ₹8.5L (33% CAGR)

Gold: ₹3.6L (8% CAGR)

“Ignore trends. Bet on India’s core needs,” he advises. Tools like GemsCor’s Portfolio Builder (gemscor.com) simplify such splits.

5 Deadly Sins to Avoid with Rs 10 Lakhs

Putting All in One Basket: 70% of Indians invest only in FDs/real estate—miss equity gains.

Chasing ‘Hot’ Tips: 82% of IPO investors lose money in 1 year (SEBI).

Ignoring Taxes: Debt funds held <3 years? Taxed at 30%.

Overlooking Liquidity: Can’t sell property quickly? Keep 20% in liquid assets.

Timing the Market: Missed the 2023 rally? SIPs beat lump-sum 80% of the time.

Future-Proofing Your Rs 10 Lakhs: 2025 and Beyond

AI & Automation: Invest in AI-focused ETFs.

Climate Tech: Solar, EV stocks set to boom.

Aging Population: Pharma, healthcare funds.

“The next Infosys will be in renewable energy,” predicts Nandan Nilekani.

FAQs: 15 Questions Real Investors Are Asking

Is real estate safer than stocks?

Depends—illiquid vs. volatile. Diversify.How much returns can I expect?

10-12%/year with moderate risk.Should I pay off loans first?

If loan interest >7%, yes.Best app to invest Rs 10 lakhs?

GemsCor (gemscor.com) for curated portfolios.How to reduce taxes?

Use ELSS, tax-loss harvesting.Is crypto legal in India?

Yes, but taxed 30% on gains.What if markets crash?

Hold—recovery averages 1.3 years.How to track investments?

Apps like ET Money, GemsCor.Can I invest in US stocks?

Yes! Via platforms like Vested.Is Rs 10 lakhs enough to retire?

Not alone. Needs compounding.Best SIP for Rs 10 lakhs?

Parag Parikh Flexi Cap Fund (14% CAGR).How much in gold?

5-10% as hedge.What’s a SWP?

Systematic Withdrawal Plan—earn monthly post-retirement.Are FDs safe?

Yes, but post-tax returns ~5%.How to start?

Split per your risk profile—use planner (gemscor.com).

Final Move: Don’t Wait, Automate

Procrastination is the silent killer of wealth. Set up:

SIPs: Automate equity/debt investments.

Emergency Fund: 6 months’ expenses in liquid funds.

Review: Rebalance every 6 months.

Tools like GemsCor (gemscor.com) automate 90% of this—freeing you to live life.

Bottom Line

Investing ₹10 lakhs in 2025 offers numerous opportunities. The key is to align your investments with your financial goals, risk tolerance, and time horizon.

Remember, diversification is crucial. Don’t put all your eggs in one basket.

Ready to take the next step? Explore tailored investment solutions at https://gemscor.com/